8 minute Read

Energy Transition: Part 2 – The Changing Energy Mix

Written By: Ian Mackenzie

First Published: (Last Updated: )

4 years ago, I discussed the oil industry in-fighting between the US shale frackers and the National Oil Companies, whilst they ignored the existential threat from Renewables approaching like a meteorite (see blog -Remember to look up).

The Renewables meteorite has now well and truly landed and its impact is beginning to sweep round the world’s energy industry. The energy transition is now well underway and will happen faster than many people think so in this blog (part 2 from 3) I aim to explore what is driving the change, where it takes us, the opportunities it presents and where work is still needed.

The Experience Curve

First, we need to start with the experience curve, which I believe is the real driving force behind the changing energy mix.

Whilst Fossil Fuels have long since reach the bottom of the experience curve, with only very small gains to be made, renewables still have a long way to run down the curve. There are countless examples of how we underestimate the impact of the experience curve, an example of this from 1985 is when the US Telecom company AT&T hired consultancy Mckinsey to assess how many people will adopt mobile phones by the year 2000. Their assessment was 900,000, the actual number was 109 million.

The key thing to consider here is Renewables are a technology not a fuel, and have a significant amount of cost reduction and technology improvement ahead. The following numbers speak for themselves.

Experience Curve in Action:

In 2010 offshore wind in the UK cost around $180 per megawatt hour. By 2017 new contracts were being awarded at $73 and in 2019 12 new projects were awarded with prices of between $50 and $53 per megawatt hour. Prices are expected to fall further as the expansion of offshore wind continues.

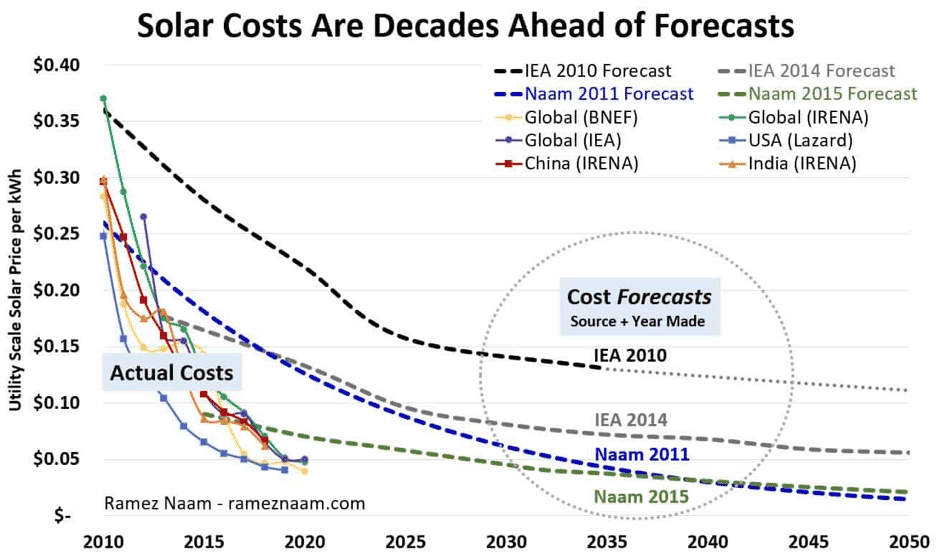

Globally it is Solar PV that is setting the pace for transition with a recent award in Qatar at $15.67 per megawatt hour and closer to home an award for $16 per megawatt hour in Portugal. According to Swanson’s law the price of Solar PV drops 28% every time the amount deployed doubles and with many doublings yet to happen, it is inevitable that Solar PV will soon break the $10 mark per megawatt hour. People have often underestimated the how steep these cost reduction curves can be. The following chart from Ramez Naam compares estimates for Solar costs vs actual costs since 2010.

To put all these numbers into perspective the average UK household pays around $185 per megawatt hour for electricity, the new Hinkley Point C nuclear power plant has a price of $118 per megawatt hour and gas averages around $64 to $70 per megawatt hour making renewables the cheapest form of electrical energy on the planet bar none.

However, renewables are intermittent, where are we going to store the energy for when we need it? Also what happens when there is too much wind and solar? Is that power wasted through renewable curtailment? Well offshore wind in particular is a lot more consistent than people might realise and we already have pumped storage and international subsea interconnectors to help balance supply and demand. However the big game changer here is likely to be battery storage. Battery storage prices continue to fall from $273 per kwh in 2016 to $187 in 2019 and Bloomberg now expects battery prices to average $94 per kw in 2024 and $62 by 2030. With Elon Musk promising to half the cost of Tesla batteries within 3 years a massive disruption is now underway with electrical energy storage. Still relatively high up on the experience curve, large cost reduction in energy storage can still be expected.

This Bloomberg video from 2017 is spot on with their assessment and a great summary of the transition underway:

All of these changes, powered by the experience curve, led to one of the world’s biggest banks BNP Paribas to state last year that “For the same capital outlay new energy will deliver up to 6 to 7 x more useful energy at the wheels of a car than oil @ $60/bbl and oil will need to be at $10 to $20 a barrel to compete.”

New Paradigm

So, the economics for renewables are already compelling today and the revolution is still young with all to gain from the benefits of technology improvements, scale, and human ingenuity. As these renewable technologies continue their deployment expect records to be broken time and time again and expect Fossil Fuels to eventually pull out of the race as they will be simply unable to compete in the new paradigm which for me is simply:

“Everything that can be electrified – will be electrified”

The only thing really still missing from the puzzle is scale, so how fast will this scale arrive?

According to BNEF a 12TW expansion of generating capacity will be built requiring $13.3 trillion of new investment between now and 2050 77% of which will be in Solar or Wind. But keep in mind the experience curve, huge spending like this will only reinforce further cost reduction, technology improvement and in my view potentially accelerate this change faster than current estimates. The picture for renewables couldn’t be brighter.

On the opposite side of the fence sits old King Coal where the contrast is stark. Investment in new coal mines is drying up and the whilst new coal fired powered stations are still being built in Asia, demand in the rest of the world is collapsing. Newly built coal fired power stations will essentially take on the role of peaker plants and now risk becoming stranded assets, even if investors right off the capital expenditure due to their high operational costs vs costs for renewables.

It is only a matter of time before the use of Oil and Gas for electrical generation will inevitably follow coal’s trajectory with investors increasingly keen to avoid holding fossil fuel assets in their portfolios. I will agree that existing gas fired power stations will have a place to provide peaker plant electricity production for some time to come. However, in due course the relentless build out of renewables at lower and lower cost, the growth of the flexible grid and increasing battery storage will mean that gas peaker plants will be used less and less and ultimately this last bastion of fossil fuels in electrical power generation will cease. In my view in the UK and much of Europe gas peaker plants will be almost out of business by the end of this decade and the rest of the world will follow in the 2030s.

These trends pose a very real existential threat to existing fossil fuel business models. Oil Majors such as BP, Shell and Total have recognised this and are now beginning to invest more heavily in renewables (I expect this investment will grow further), and may allow some to transform to a low carbon energy businesses and avoid a Kodak moment. Others will not be so fortunate.

Innovation still required

But whilst the case for moving the electrical grid to renewable power is compelling some parts of the energy puzzle are not so easily solved. Electricity represents only 1/5 of the typical energy consumption for an average sized UK home with the other 4/5 supplied by gas for heating. Improvements to home insulation will certainly help however, there are still huge challenges ahead to solve in decarbonising heat. A number of technologies offer the potential to solve this from electric boilers, heat pumps, and even hydrogen, however none of these currently compete with gas economically for heating, but let’s not forget the experience curve. These technologies are still in their infancy and have a long way to run. For my money I’ll be betting on electric boilers and heat pumps over hydrogen given our new maxim – Everything that can be electrified will be electrified, however Hydrogen will also have a place in the new energy world (Planes, Ships and Steel Making – in my view). What is clear is that heating is an area ripe for disruption and innovation with a huge potential to make a positive impact.

Social Case

Finally, if the economic case for change wasn’t compelling enough, the social and moral obligation to deal with climate change should be. The UN Environment Programme estimates that the global cost of adapting to climate change is expected to grow to $140-300 billion per year by 2030 and $280-500 billion per year by 2050. Political pressure is growing for change, which simply can’t be ignored, and even China the world’s largest emitter has recently announced they will reach Net Zero by 2060. With COP26 in Glasgow next year I expect we will see growing commitments to Net Zero. However, these commitments are no longer driven by moral obligation alone, instead now that the advantages of a net zero economy are beginning to come clear, national governments are keen for their economies to benefit and capture new technology developments and the export opportunities they present. In this way what was once a maddeningly slow crawl towards the net zero finish line will increasingly become more like a race to the new energy world.

In Conclusion

Our energy mix is changing and this change is being driven by a number of factors, the strongest of these is economics (thanks to our friend the experience curve). Thankfully it looks as though humanity has many of the solutions to the crisis we have created although further innovation is definitely required – great opportunities are out there for those willing to innovate and take part.

The transition is now underway and we need to avoid underestimating the speed at which disruption happens at. In my view this transition is great news for our planet and a window of opportunity is open to build a better world, where people can access clean energy at lower costs for far into the future.

The job we all now have is to embrace this great transition, embrace innovation and embrace our part towards making this change a reality as quickly as possible.

Next week I’ll get personal and explore my own journey.